London’s rental market is currently being reshaped by a massive wave of corporate restructuring as property owners race to shield their profits from a tightening fiscal net.

The Corporate Shield and the Tenant’s Burden

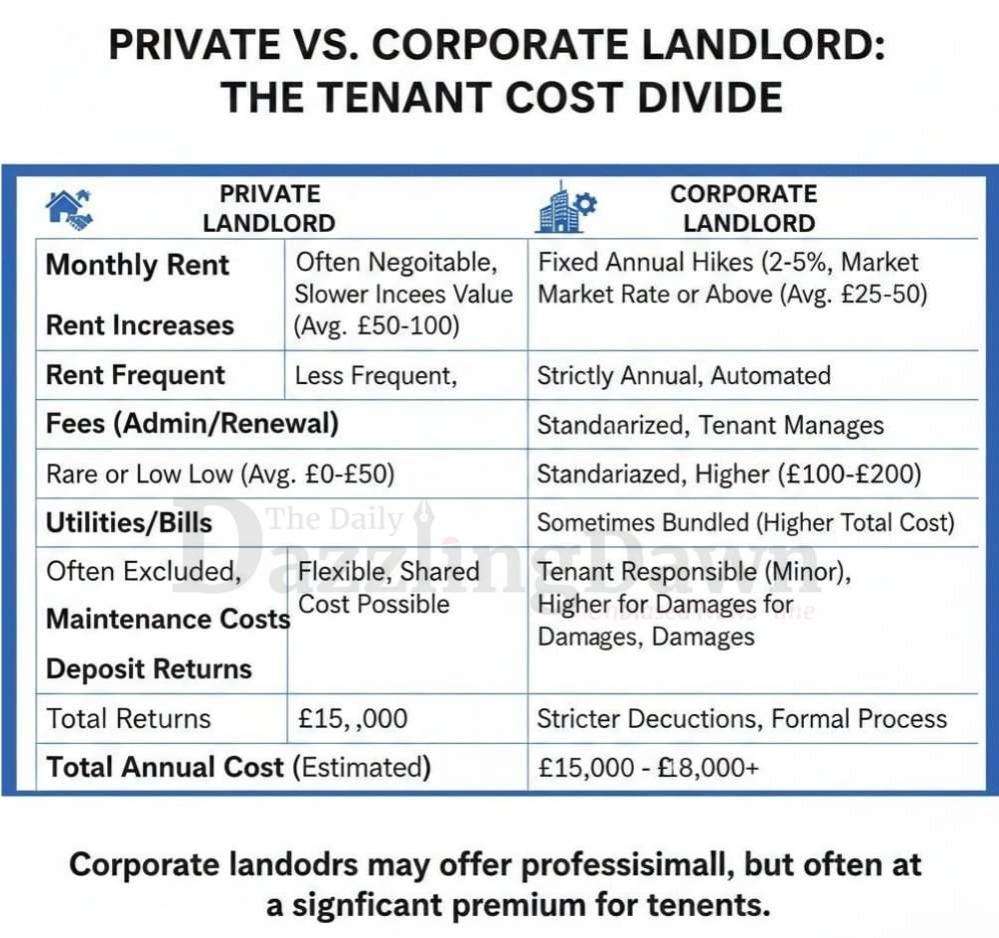

While the national headlines highlight the record 66,000 new buy-to-let companies formed over the past year, the real impact is being felt on the doorsteps of London’s renters. This migration to "limited company" status is a direct defensive response to the 2026 tax overhaul, which introduced a 2% income tax surcharge on personal rental earnings—a cost corporate structures effectively bypass. For Londoners, this professionalization often means the end of flexible, personal tenancies and the rise of automated, profit-led management where rent increases are hardcoded into annual corporate targets.

As landlords consolidate into companies to protect their margins, the overhead costs of maintaining these entities are frequently passed directly to the tenant. We are seeing a fundamental shift in the city: the "accidental landlord" is being replaced by a streamlined corporate entity that prioritizes shareholder yield over community stability. In a city where housing is already a premium, this transition turns every flat into a line item on a balance sheet.

Capital Squeeze: Why London Rents Are Primed to Peak

The surge in incorporations is most aggressive in London’s high-yield hotspots. Emerging data for early 2026 identifies Tower Hamlets (Canary Wharf), Southwark, and Barking & Dagenham as the boroughs with the highest concentration of new corporate landlord registrations. In these areas, the "affordability ceiling" is already being tested, and as landlords pivot to avoid the 2% personal tax surcharge, they are justifying rent hikes to cover the legal fees of incorporation. While newly advertised rents have shown signs of stabilizing in Prime Central London, "renewal rents"—those paid by existing tenants in boroughs like Hackney and Lambeth—are rising at twice the rate of new lets.

The timing of this boom is critical as the capital prepares for the May 1, 2026, implementation of the Renters’ Rights Act. By moving into corporate structures, larger investors are pre-emptively adjusting to the ban on rental bidding wars and the abolition of "no-fault" evictions. Paradoxically, by stopping tenants from bidding up prices, the law has encouraged corporate landlords to set much higher initial "sticker prices." In East London hubs like Stratford, these tax-efficient corporate giants are now outcompeting individual buyers for remaining stock, ensuring that rental growth remains the city's primary housing driver.

Future Outlook for the London Rental Sector

Looking ahead, the next phase of this transformation will see the dominance of "Build-to-Rent" (BTR) institutions. The record-breaking company formation numbers are merely the first stage of a total institutionalization of London’s housing stock. Renters should prepare for a future where their "landlord" is a faceless management firm using AI to track market trends and trigger automated rent increases the moment a contract expires.

As we move deeper into 2026, the collision of tax avoidance and tenant protection will likely squeeze out the remaining small-scale landlords. The government may soon face pressure to address how these corporate tax loopholes are indirectly fueling the city's affordability crisis. For now, the message is clear: the London rental market is no longer a community of homes, but a high-efficiency corporate machine, with the city's tenants paying the premium for its maintenance.

.svg)